The global authority in superyachting

- NEWSLETTERS

- Yachts Home

- The Superyacht Directory

- Yacht Reports

- Brokerage News

- The largest yachts in the world

- The Register

- Yacht Advice

- Yacht Design

- 12m to 24m yachts

- Monaco Yacht Show

- Builder Directory

- Designer Directory

- Interior Design Directory

- Naval Architect Directory

- Yachts for sale home

- Motor yachts

- Sailing yachts

- Explorer yachts

- Classic yachts

- Sale Broker Directory

- Charter Home

- Yachts for Charter

- Charter Destinations

- Charter Broker Directory

- Destinations Home

- Mediterranean

- South Pacific

- Rest of the World

- Boat Life Home

- Owners' Experiences

- Conservation and Philanthropy

- Interiors Suppliers

- Owners' Club

- Captains' Club

- BOAT Showcase

- Boat Presents

- Events Home

- World Superyacht Awards

- Superyacht Design Festival

- Design and Innovation Awards

- Young Designer of the Year Award

- Artistry and Craft Awards

- Explorer Yachts Summit

- Ocean Talks

- The Ocean Awards

- BOAT Connect

- Between the bays

- Golf Invitational

- BOATPro Home

- Superyacht Insight

- Global Order Book

- Premium Content

- Product Features

- Testimonials

- Pricing Plan

- Tenders & Equipment

How Jordan Belfort's 37m superyacht Nadine sank off the coast of Sardinia

Related articles.

Coco Chanel was famously outspoken on many things, but yachting, in particular, attracted her ire. “As soon as you set foot on a yacht you belong to some man, not to yourself, and you die of boredom,” she was once quoted as saying.

Her solution was to buy her own yacht. A 37m with a steel hull, built by the Dutch yard Witsen & Vis of Alkmaar. The yacht passed through many hands, finally ending up belonging to the Wolf of Wall Street, Jordan Belfort, on whose watch she foundered and sank in 1996.

The yacht was originally built for a Frenchman under the name Mathilde , but he backed out and she caught Chanel’s eye instead. With a narrow beam, a high bow and the long, low superstructure typical of Dutch yachts of her era, she was certainly a beautiful boat. But she was also well equipped, with five staterooms in dark teak panelling, magnificent dining facilities, room for big tenders and, later, a helipad. A frequent sight along the Florida coast, she caught the eye of a young skipper called Mark Elliott.

“In those days, she was the biggest yacht on the East Coast,” he remembers. “Nobody had ever seen anything like it. I needed a wrench once and went up to the boat - Captain Norm Dahl was really friendly.” He didn’t know it then, but Elliott was destined to become the skipper of the boat himself and was at the helm when the storm of the century took her to the bottom off Sardinia.

Coco Chanel died in 1971 and sometime thereafter the yacht was renamed Jan Pamela under the new ownership of Melvin Lane Powers. He was a flamboyant Houston real estate developer, fond of crocodile skin cowboy boots and acquitted of murder in a trial that gripped the nation.

Powers sent Jan Pamela to Merrill Stevens yard in Miami, where a mammoth seven-metre section was added amidships. “We made templates for the boat where we were going to cut her in half, then she went out for another charter season,” remembers Whit Kirtland, son of the yard owner. “When the boat came back in, we cut it just forward of the engine room, rolled the two sections apart and welded it in.”

He remembers how the sun’s heat made the bare and painted metal expand at different rates. “You had to weld during certain time periods – early in the morning or late at night,” says Kirtland.

The result of the extension was a huge new seven-metre full-beam master stateroom, an extra salon and one further cabin – pushing the charter capacity to seven staterooms. During this refit, the boat’s colour was also changed from white to taupe. “No one had really done it before and it was gorgeous,” says Elliott. By 1983, Powers was bankrupt and the yacht was sold on again. She next shows up named Edgewater .

Elliott’s chance came in 1989. He was working for the established yacht owner Bernie Little, who ran a hugely profitable distribution business for Bud brewer Anheuser-Busch. “Bernie Little had always wanted to own the boat,” Elliott says. “He loved it. He bought it sight unseen – and I started a huge restoration programme, including another extension to put three metres in the cockpit.”

It was a massive task, undertaken at Miami Ship. “We pulled out all the windows, re-chromed everything, repainted – brought it back to life,” says Elliott. They also cut out old twin diesels from GM and replaced them with bigger CAT engines, doubling her horsepower to 800. “Repowered, she could cruise at up to 20 knots. She was long and skinny, like a destroyer.”

A smart hydraulic feature was also brought to life for the first time. Under two of the sofas in the main stateroom were hidden 3.6m x 1.2m glass panels giving a view of the sea under the boat. At the push of a button, the sofas lifted up and mirrors above allowed you to gaze at the seabed – from the actual bed.

Now called Big Eagle , like all of Little’s boats, she was a charter hit and her top client was a certain New York financier named Jordan Belfort. He fell in love with her and begged Little to sell to him. But he needed to secure financing, and in 1995, Little agreed to hold a note on the boat for a year if Mark Elliott stayed on as skipper.

With the boat rechristened Nadine after his wife, Belfort set about another round of refit work, restyling the interior with vintage deco and lots of mirrors, extending the upper deck this time, and fitting a crane capable of raising and stowing the Turbine Seawind seaplane.

Nadine also carried a helicopter, a 10m Intrepid tender, two 6m dinghies on the bow, four motorbikes, six jetskis, state-of-the-art dive gear. “You pretty much needed an air traffic controller when all these things were in the water,” says Elliott.

Belfort’s partying was legendary and Elliott clearly saw eye-watering things on board, but as far as he was concerned, he was there to safeguard the boat. “When Jordan Belfort became the owner, he could do whatever he wanted. I was there to protect the note,” says Elliott. “He is a brilliant mind and a lovely person. It was just when he was in his party mode, he was out of control.”

Nadine and her huge cohort of toys and vehicles plied all the usual yachting haunts on both sides of the Atlantic. But Belfort’s love story was to be short-lived. Disaster struck with the boss and guests on board during an 85-mile crossing between Civitavecchia in Italy and Calle de Volpe on Sardinia.

What was forecast to be a 20-knot blow and moderate seas degenerated into a violent 70-knot storm with crests towering above 10.6m, according to Elliott. Wave after wave pounded the superstructure, stoving in hatches and windows so that water poured below and made the boat sluggish. By a miracle the engine room remained dry and they could maintain steerage way, motoring slowly through the black of the night as rescue attempt after rescue attempt was called off.

Nadine eventually sank at dawn in over 1000m of water just 20 miles from the coast of Sardinia. Everyone had been taken off by helicopter, and there was no loss of life. Captain Mark Elliott was roundly congratulated for his handling of the incident. “The insurance paid immediately because it was the storm of the century,” he says. “I took the whole crew but one with me to [Little’s next boat] Star Ship . That was my way to come back.”

Sign up to BOAT Briefing email

Latest news, brokerage headlines and yacht exclusives, every weekday

By signing up for BOAT newsletters, you agree to our Terms of Use and our Privacy Policy .

More stories

Most popular, from our partners, sponsored listings.

Join our Newsletter

Subscribe to B.H. Magazine

Share the article.

Uber Boat Is Launching Just In Time For Your Euro Summer Antics

The Candela C-8 Travels Above Water To Completely Reimagine Boating

Royal Huisman’s Project 406 Is The World’s Largest Purpose-Built Fishing Boat

Ferrari Is Officially Entering The Yacht Game

Steven Spielberg Takes Delivery On His Cinematic $250 Million Superyacht

Related articles.

The 33-Metre Sanlorenzo SP110 ‘Steel It’ Motor Yacht Is A Jet-Powered Masterpiece

Conor McGregor Enjoyed The Monaco Grand Prix From His $5.5 Million Lamborghini Yacht

BMW Debuts ‘The Icon’ Boat With Soundscape Designed By Hans Zimmer

Step Inside The 75m Kenshō: 2023’s Motor Yacht Of The Year

Russian Superyacht’s Crew Spends Past Year Playing ‘Call Of Duty’ & Chilling By Pool

- TV & Film

- Say Maaate to a Mate

- First Impressions - The Game

- Daily Ladness

- Citizen Reef

To make sure you never miss out on your favourite NEW stories , we're happy to send you some reminders

Click ' OK ' then ' Allow ' to enable notifications

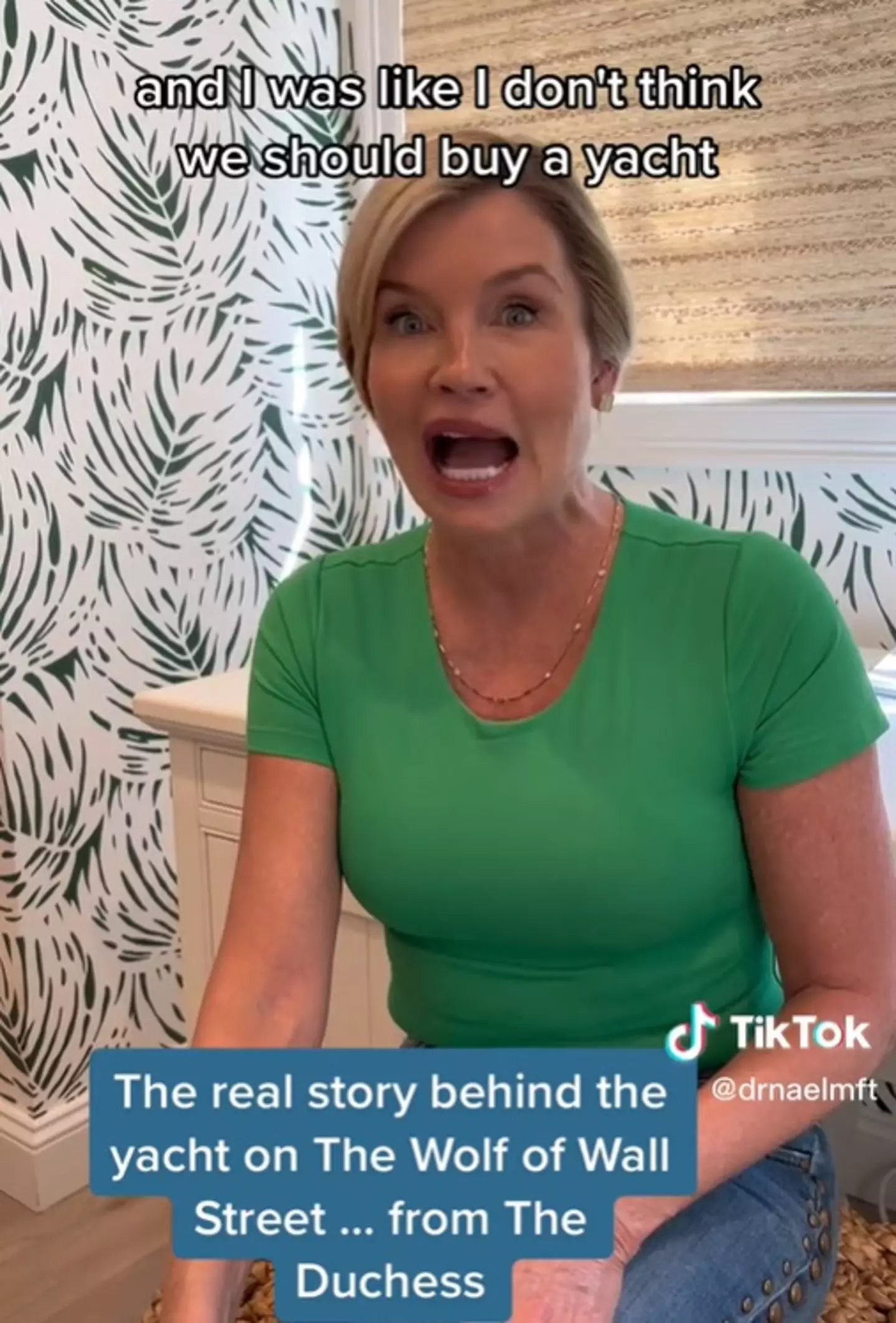

Jordan Belfort’s ex-wife tells the real story behind the yacht on The Wolf of Wall Street

The ex-wife of jordan belfort shed some light on the infamous scene.

Ben Thompson

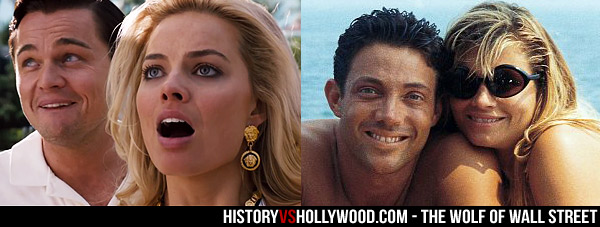

Jordan Belfort's ex wife, Nadine Macaluso, has set the record straight about the scene in The Wolf Of Wall Street where Belfort splashes out and buys his wife a yacht on their wedding day.

I mean, when you have a lot of money , what better way to treat your new spouse after saying I do?

After their lavish wedding, Belford ( Leonardo DiCaprio ) covers Nadine's, or Naomi as she's known in the movie, eyes with a blindfold before revealing the huge yacht, which has been christened the 'Naomi'.

And Naomi (played by Margot Robbie ) cannot contain her excitement.

"Are you serious? A f***ing yacht?!" she exclaims.

However, it seems that the real Belfort wasn't very serious, as Macaluso revealed on TikTok that her ex-husband, who she was married to from 1991 to 2005, 'did not' actually buy her a boat on their wedding day.

She said: "Actually what happened I think we were married for a few years and we were always chartering yachts, because he loved to do that.

"And I had given birth to my beautiful daughter Chandler and he said 'I want to buy a yacht'."

However, this idea didn't sit well with Macaluso at the time.

She continued: "I said 'I don't think we should buy a yacht, we have a baby and I don't feel comfortable.

'She can't swim.'

"I had visions of her falling off the boat and I was actually terrified.

"I did not want to buy the yacht ironically. And he was like 'Nope, I'm buying a yacht and I'm calling it the Nadine'. And I was like 'Okay, here we go'.

"And you know how that went."

Macaluso's final line is a nod to a scene in the film, in which Belfort and Naomi need to be rescued from the yacht after it gets caught up in a storm.

This scene was indeed based on the real life sinking of the ship in June 1996, which resulted in a rescue by the Italian Navy Special forces.

The yacht was sunk after violent waves repeatedly hit it, but luckily everyone on board was able to escape the ship in time.

Macaluso has previously commented on the scene's accuracy , where she admitted in a TikTok video that the yacht sinking scene was 'totally true'.

Speaking of the memory, she said: "It was horrific, horrifying, we were in a squall for 12 to 18 hours and we lived, thank god, for my kids."

She even showed real life footage of her, Belford and their friends being rescued by the Navy.

Topics: TV and Film

- Real footage from Wolf of Wall Street beach party as Jordan Belfort's ex-wife confirms disturbing act happened

- Real Wolf of Wall Street's ex-wife gave Margot Robbie important advice about doing completely nude scene

- Real Wolf of Wall Street’s ex-wife shares common ‘red flag’ that means your partner might be cheating

- Company Looking To Pay Someone €50 An Hour To Watch Wolf Of Wall Street

Choose your content:

British gangster thriller on Netflix with near-perfect Rotten Tomatoes score is so violent fans think it’s a horror movie

The gruesome gangster thriller has a near-perfect rotten tomatoes, and can be watched on netflix.

Clarkson’s Farm set for biggest project yet as Lisa announces huge expansion and opening date

Lisa hogan runs diddly squat farm alongside her partner jeremy clarkson.

Ryan Reynolds has heart-warming response as Blake Lively's new film surpasses Deadpool and Wolverine

It ends with us and deadpool & wolverine battled it out for a box office number one.

People just realising E.T. has an actual first name that most of us missed

E.t. is not actually called e.t. even though that's what everyone calls him.

- San Lorenzo

- Yacht Rental in Dubai Marina

- Yacht Party Dubai

- Overnight Experience

- Formula 1 Abu Dhabi

- Corporate Events

- Fifa World Cup 2022

- Anniversary Celebrations

Connect with a yacht expert & get per personalised Deals

Jordan Belfort Yacht: The True Story and The Wolf of Wall Street Version

The true Jordan Belfort yacht story is as strange and unbelievable as the hit movie The Wolf of Wall Street depicts it to be. There are several insider stories behind the sinking of the mighty yacht that are not widely known but are quite interesting and different from the reel version in several ways.

What happened to the Jordan Belfort yacht Nadine?

As the movie, The Wolf of Wall Street shows, the superyacht Nadine sank close to the coast of Sardinia in 1997 while battling what many calls “the storm of the century”. Jordan Belfort narrates the event in detail in the memoir describing his life in the 90s, which is what the Martin Scorsese movie is about.

Before getting into the details of the sinking, it is worth noting that the 37m yacht had a long and interesting history. She carried renowned celebrities like Coco Chanel before reaching Jordan Belfort (played by Leonardo DiCaprio in the movie) and was one of the largest yachts in the East Coast’s waters.

While the yacht was initially manufactured for a French native and given the name Matilda, he backed out of the deal. This led Coco Chanel to buy the beautiful yacht with the low superstructure that Dutch yachts are famous for.

You can learn more about our yacht charter services in Dubai

The yacht took on different names as it passed through famous hands, even those of the murder trial acquitted Melvin Lane Powers. Belfort named the yacht after his wife and renovated it with the capacity to carry a helicopter, 6 Jetskis, 4 motorbikes, and much more. Under Belfort’s ownership, the yacht witnessed a series of wild parties that were like unlimited glamour and fun in a package until disaster struck unexpectedly.

Did the yacht scene in The Wolf of Wall Street actually happen?

The Jordan Belfort yacht sinking scene in The Wolf of Wall Street was heavily inspired by a real-life event, though the movie did take some creative liberties. For one, the yacht was called Naomi in the reel version since the name of Belfort’s wife (played by Margot Robbie ) was changed in the movie. In reality, the yacht was named Nadine.

The movie further depicts Belfort’s helicopter getting thrown off the yacht by strong waves. In reality, the yacht’s crew went up to the deck and pushed off the helicopter so that Italian navy seals would have a space to land. The yacht’s itinerary was altered a bit by the movie’s director Martin Scorsese to add to the drama, though the power of the storm was scarily accurate.

Belfort admitted that the yacht’s captain Mark Elliot explicitly warned them not to sail to Sardinia on that fateful night. But according to the movie, there was a business opportunity in the city that Belfort could not bear to miss out on despite his wife’s protests.

Some sources claim that in reality, the passengers were simply eager to hit the golf course at Sardinia the next morning. They refused to pay heed to the captain’s warning and asked him to go through the storm, which eventually led to the famous Jordan Belfort yacht sinking incident. Therefore, unfortunately, if someone wants to have a yacht rental in Dubai or any other destination, they have missed their chance with this yacht.

Take a look on our Yacht Dubai Party

Interesting insights on the sinking as portrayed in the movie

The movie captures the fear and stress that each passenger felt when the yacht got caught up in the 70-knot storm. There is some hilarity when Belfort starts yelling for his drugs to avoid the horror of dying sober.

Several rescue attempts were made, but due to rising risks, each of them was called off. By some twist of luck, the yacht’s engine room remained mostly undamaged for a while, because of which they were able to make their way through the sea.

In the end, everyone survived the incident without any major injuries. At dawn, the Nadine made its way 1000m under the water only 20 miles away from Sardinia’s coast. Now, the movie’s audience gets to watch the Jordan Belfort yacht story unfold on the screen with a pinch of humor.

The Nadine’s captain Mark Elliot’s heroic actions did not go unnoticed. He was praised for leading all the passengers to safety, though he was able to get out of the yacht only 10 minutes before it sank. The captain also admitted that the insurance was granted immediately considering the ferocity of the storm. As for the yacht, many still wonder about the highly expensive equipment that had to be thrown into the water and is probably rusting away at the bottom of the sea.

The best features of the Jordan Belfort yacht Nadine

The 167 ft Nadine, as its former passengers claim, was a beautiful yacht. When owned by Coco Chanel under the name Matilda, the yacht had five staterooms, large dining areas, and a helipad. The interiors were furnished with dark teak paneling. Each new owner customized the yacht’s name and interiors based on their tastes.

Belfort decorated the Nadine lavishly with a variety of mirrors and set a vintage deco theme. He renovated the upper deck to fit a crane that was able to stow his Turbine Seawind seaplane. The yacht carried the best dive gear available in the market plus a variety of Belfort’s ‘toys’ such as his motorbikes and jetskis.

Which model was portrayed as the Jordan Belfort yacht Nadine in the movie?

Martin Scorsese got the yacht Lady M to represent Nadine onscreen. While Nadine actually had a luxuriously vintage charm to it, Lady M is a modern vessel with contemporary features. Lady M was manufactured in 2022 by Intermarine Savannah, while Nadine was built in 1961 by Witsen & Wis. The 147 ft Lady M is currently worth $12 million and is similar to Benetti yachts in its glamorous design.

Jordan Belfort’s life today

The entrepreneur and speaker Jordan Belfort’s shenanigans are well-known thanks to his detailed memoir and the hit movie based on some parts of his life. He spent 2 years in prison and now, at 59 years of age, has a practically negative net worth. Yet, his extraordinary motivational speaking skills continue to attract and inspire people even today.

It is easy for anyone watching the movie to wonder if many of the incidents are exaggerated. But considering Belfort’s eccentric life, even the Nadine sinking incident remains another regular anecdote shared in the movie.

PER HOUR Per Day

Browse our Yachts

Screen Rant

How accurate the wolf of wall street is to the true story.

Your changes have been saved

Email is sent

Email has already been sent

Please verify your email address.

You’ve reached your account maximum for followed topics.

10 Scorsese Trademarks In The Wolf Of Wall Street

What happened to the real jordan belfort after the wolf of wall street, “the actual moviemaking is top notch, who cares”: furiosa’s cgi comparisons to mad max: fury road defended by vfx artists.

- The Wolf of Wall Street is based on the true story of Jordan Belfort, a con artist who became famous for his fraudulent actions.

- The movie features memorable moments from Belfort's memoir, such as smuggling money into Swiss banks and sinking a yacht.

- However, several real-life figures have disputed the accuracy of the events depicted in the movie, suggesting that Belfort may have exaggerated or fabricated certain elements to suit his own narrative.

Martin Scorsese's The Wolf of Wall Street is based on the true story of the infamous rise and fall of American stockbroker and criminal Jordan Belfort. Leonardo DiCaprio plays Belfort in the movie, exploring his outrageous lifestyle, the various figures in his life, and the crimes that led to his downfall. The dramatized version of events depicted in the movie rings mostly true to the 2007 memoir of the same name. However, there are a lot of criticisms of how Belfort depicts himself and the truth, including from people featured in The Wolf of Wall Street.

The real Jordan Belfort of The Wolf of Wall Street story has been called a manipulative conman by many, so it's plausible that his memories and anecdotes of the events depicted in the movie and book are flawed and exaggerated to suit his allegedly inflated self-image. A number of real-life sources have spoken out about the inaccurate depiction of events in Belfort's story, hinting that Belfort's fraudulent sensibilities might have fooled Hollywood as they did on Wall Street.

From voiceover narration to dark humor, The Wolf of Wall Street exhibits many of the stylistic trademarks of its director Martin Scorsese.

The Wolf Of Wall Street Is Accurate To Jordan Belfort's Memoir

Various successes and failures depicted in the movie came from belfort's own admission.

There are several key details in Martin Scorsese's The Wolf of Wall Street that have been confirmed to be true based on Belfort's representation of himself and his brokerage firm Stratton Oakmont in his memoir. According to the memoir, Belfort actually had his in-laws smuggle money into Switzerland banks, and Stratton Oakmont really helped make the luxury shoe line Steve Madden go public. The depiction of Matthew McConaughey's The Wolf of Wall Street character Mark Hanna is also based on Belfort's description, including Hanna's crude philosophy that the key to success was masturbation, cocaine, and sex workers.

Other details in the movie that were accurate to Belfort's memoir include: Donnie Azoff (inspired by the real-life Danny Porush, played by Jonah Hill in the movie) did marry his cousin before later divorcing her, Belfort sunk a yacht in Italy that was once owned by Coco Chanel, and he did crash his helicopter trying to land while he was high. Most notably, Belfort truly did serve a reduced prison sentence after informing on his friends . He did not try to save Porush (Azoff) from incriminating himself, as is displayed in the film. He informed on Porush in real life.

| Scenes in Accurate To Jordan Belfort's Memoir |

|---|

| Belfort's in-laws really smuggled money into Switzerland banks |

| Stratton Oakmont really made luxury shoe line Steve Madden go public |

| The depiction of Matthew McConaughey's character, Mark Hanna |

| Donnie Azoff really married his cousin (he later divorced her) |

| Belfort really sunk a yacht in Italy that was once owned by Coco Chanel |

| Belfort really crashed his helicopter while high |

| Belfort really served a reduce prison sentence for informing on his friends |

Wolf Of Wall Street's Accuracy Has Been Disputed By Key Figures

The depiction of belfort's crimes has become a controversial topic for the movie.

The Wolf of Wall Street has been criticized for how much it downplays the victims of Belfort's crimes, and it largely focuses on him ripping off the wealthy. According to the New York Times , Belfort targeted people from all types of financial backgrounds to buy his worthless stocks.

One California man used his home equity line of credit to invest with Belfort and has been impacted financially ever since (via New York Times ). The depiction of Belfort in Scorsese's movie as being some type of voice of an underprivileged class who was righteous in turning the system on its head and against itself has been debated since the film's 2013 release.

The real-life Donnie and Naomi also dispute a lot of what happens in both Jordan's memoir and Scorsese's movie. Nadine Macaluso, who is represented by the character Naomi, played by Margot Robbie in The Wolf of Wall Street , claimed that the movie was mostly accurate through Jordan's perspective, but not through an objective lens or with consideration to Nadine's point of view concerning their marriage. Nadine went on to get a Ph.D. and became an expert in relational trauma ( via The Independent ).

Danny Porush told Bustle that most of the film is completely fictitious, claiming that nobody in real life ever called Belfort the "Wolf" nor was there any throwing of little persons or chimpanzees that took place in the office.

As crazy as it seems, The Wolf of Wall Street was based on the true story of Jordan Belfort, who went on to deal with the consequences of his actions.

Why Wolf Of Wall Street's Accuracy (Or Otherwise) Is Part Of Its Legacy

Does the movie glorify jordan belfort.

The glorification of the debauchery surrounding Belfort's lifestyle and business practices is suitable to the mystique around whether or not the film depicts real events. This disparity in what is actually true in the movie and memoir versus what other real-life parties have to say about fabrications is part of its reckless and dysfunctional appeal.

Even Scorsese himself came under fire for celebrating the corrupt actions of the bonafide con artist in his film, which is meant to be seen as an overarching satire of capitalism rather than a stamp of approval for Belfort . Regardless of its degree of accuracy, The Wolf of Wall Street is a wildly entertaining exercise on limitless greed.

How Jordan Belfort's Life Has Been Changed By The Movie's Legacy

Belfort has become more famous thanks to scorsese's movie.

While Jordan Belfort and his past crimes helped him make a name for himself after his time in prison, Martin Scorsese’s movie has further raised the man's profile. In the years following the release of The Wolf of Wall Street , Belfort has become more well-known as a pop culture figure and he continues to parlay the success of the movie into his own personal success .

Jordan Belfort’s net worth in 2024 might be significantly less than what he was making at the peak of his criminal activity, but he is still amassing a fortune thanks largely to his career attending speaking engagements. Much like with the movie itself, it has been debated whether Belfort’s speeches were taking responsibility for his crimes or celebrating the debaucherous lifestyle he participated in. Since the release of the movie, Belfort has released two books, 2017’s Way of the Wolf: Straight Line Selling: Master the Art of Persuasion, Influence, and Success and 2023’s The Wolf of Investing.

In 2020, Belfort sued producers of The Wolf of Wall Street for fraud, asking for $300 million in compensation. Belfort maintained that the producers of the company Red Granite were involved in a multi-million-dollar embezzlement scheme and used stolen money to buy the movie rights to his story. As of the filing of the lawsuit in 2020, there has been no news on the case.

Source: The New York Times , Time , The Independent , Bustle

The Wolf of Wall Street

Not available

Directed by Martin Scorcese, The Wolf of Wall Street tells the true story of stockbroker Jordan Belfort (Leonardo DiCaprio), based on his memoir of the same name. It chronicles the rise of Belfort and the subsequent corruption of his firm as he engages in a wide assortment of criminal acts while amassing a staggering fortune. Jonah Hill, Margot Robbie, and Kyle Chandler also star alongside DiCaprio.

Iconic Scenes: The Wolf of Wall Street – The Yacht Bribe

I love The Wolf of Wall Street . I think it is a spectacular film that seems to grow more relevant as time passes. I also think that the central character and narrator, Jordan Belfort, is not the most important or key character – that is Agent Denham. So I’m looking at the brilliant scene where Belfort and Denham first meet.

What Happens

Multi-millionaire and thoroughly corrupt stockbroker Jordan Belfort invites two FBI agents to his luxury yacht after he learns that they are investigating him. Agent Denham, and a virtually silent partner, arrive for what starts as a very friendly meeting. Belfort hands over some of the information the FBI has been trying to get while constantly trying to impress them with his wealth and insisting he’s done nothing wrong. Belfort draws Denham into a conversation and it seems the FBI agent is not happy at being given the case and would be willing to play ball with Belfort. At which point, Belfort tries to bribe Denham, and then the tone changes. It’s immediately obvious that Denham is not willing to play ball and is determined to bring Belfort down. The conversation gets increasingly acrimonious and ends with Belfort literally throwing lobsters and handfuls of cash at the departing FBI agents.

When you sail on a yacht fit for a Bond villain, sometimes you gotta act the part

DiCaprio is sensational in this scene. Despite getting very good advice not to contact the FBI and try some scheming, this is exactly what Belfort does. They meet on his insanely luxurious yacht, where Belfort has beautiful women lounging on chairs, he is dressed in bright white “yacht clothes” and constantly turning on his beaming smile. He offers them lobsters and drinks. It does not seem to occur to Belfort that showing off his immense, and ill-gotten wealth, might not be the best idea when you’re being investigated for crimes in the stock market.

Belfort’s attempt at bribery is fantastic. Basically detailing a story where he advised someone in need of money in what stocks to invest in and that person making a fortune and how Belfort “would be willing to do that for anyone”. When challenged about this being a bribe Belfort reveals he researched what legally constitutes a bribe and that wouldn’t count. Again, it’s a little suspicious for someone to be able to recite the criminal code of a crime if they’re not a lawyer.

Good for you, Little Man

Oh, Agent Denham, you film stealing hero. Denham is played by Kyle Chandler who, and this is important for the Denham role, is your go-to guy for American decency (if you need someone younger than Tom Hanks), he is probably best known for his role in Friday Night Lights where he played an honourable, upstanding and inspirational football coach. Denham’s casual chatting with Belfort seems to suggest he is not interested in the case and possibly dissatisfied with his job, the attempted bribe being when he flips to his real character.

As Belfort becomes more aggressive Denham responds in kind and leads to one of the all-time best deliveries, “Good for you, little man,” when sarcastically congratulating Belfort on becoming a Wall Street douchebag without any help from anyone else. Belfort is stunned by this comment but mainly in that he can’t understand it…he’s rich, really rich, how can he be a “little man”, he’s a giant. A colossus. The embodiment of the American Dream. The thing is, of course, Denham is right.

Fun Coupons

A lot of this scene is purely about status. Of all the places Belfort could have met with the FBI agents he chooses his insanely expensive yacht. He is obsessed with money and how much the FBI agents make, originally pretending to be sympathetic but quickly changing to just mocking them. Belfort assumes that because Denham works for the FBI for what to him is an insignificant amount of money he is a loser. The idea that Denham might believe in what he’s doing is either inconceivable or at best a pitiable weakness. To me, this is the best and most interesting scene in the whole film – not the drug-filled hedonistic parties, not the cult-like team talks Belfort gives his employees, not the incredibly charismatic phone calls Belfort makes when selling stocks but this scene where Denham sizes up Belfort and sees right through him.

Years ago David Cross and Bob Odenkirk made a sketch show called Mr. Show , which contained a sketch based on the premise “someone who makes more money than you is better than you”, so Van Gogh, Einstein and Galileo are actually pretty unsuccessful people. This is Jordan Belfort’s philosophy – he is better than just about everyone he meets because he is richer.

The Hero I’m Going To Be Back At The Office, When The Bureau seizes this boat!

All Belfort manages to do in this scene is upset the FBI and probably convince them that yes, he is absolutely breaking the law. It’s an interesting look at the dynamic of power in America (and indeed the whole world) – who is the more powerful person? Belfort with his huge personal wealth or Denham as a federal officer, a representative of the most powerful country on Earth. There was a lot of discussion at the time about if people actually saw Belfort as the hero of this film, that people liked him and wanted him to win. I saw this as Goodfellas but for white-collar crime. In this scene Belfort helps further his own downfall, antagonising the FBI. In the final moments of this scene, Belfort has just finished throwing money at Denham and his arrogance and deluded grandeur fade as he realises he has just made a terrible mistake.

Also Read: Iconic Scenes: American Psycho – Business Card Scene

Richard Norton

Gentleman, podcaster and pop culture nerd, I love talking and writing about pretty much all pop culture.

Share with friends

You may also like.

Grand Theft Auto: The Movie – Coming Soon?

Scorsese’s Silver Screen Legends: De Niro vs. DiCaprio

‘Killers of the Flower Moon’ Can Open For More Indigenous Storytelling and Talent

Beyond Superheroes: What Will Define Hollywood’s Next Era?

Rethinking Audience Development In The UK Independent Screen Sector In 2024

The New Frontier of the Western

Anatomy Of A Scene: The Godfather – Restaurant Scene

The New Hollywood: Streaming Giants

Your Opinion Is Needed: A Survey on Native English Speakers’ Consumption of Non-English Film & TV Content

Horror and Folklore: Movies Inspired by Myths and Legends

Eight in 10 people In The UK with A Disability Don’t Feel Represented In The Media

Exploring Sci-Fi Noir: How Blade Runner and Ghost in the Shell Define the Sub-Genre

Privacy overview.

Everything The Wolf Of Wall Street Doesn't Tell You About The True Story

Martin Scorsese's film "The Wolf of Wall Street" is an over-the-top celebration of greed and excess, inspired by the memoir of the notorious stockbroker Jordan Belfort, who is played by Leonardo DiCaprio in the film. It tell of the rise of Jordan Belfort from a low-level assistant at L. F. Rothschild to a Long Island penny stock pusher, as well as Belfort's dramatic fall from filthy rich CEO of Stratton Oakmont to a stint in federal prison for stock fraud and money laundering.

Despite being ostensibly based on a true story, many question the veracity of the film because of how absolutely outlandishness of Belfort's claims, and how outrageous the antics at Stratton Oakmont are. Scorsese obviously recognized Belfort is an unreliable narrator with a penchant for exaggeration. In the film, Belfort breaks the fourth wall, addressing the camera and the audience directly. This was a strategic choice by the screenwriter and director. Screenwriter Terence Winter told Esquire , "Jordan is talking directly to you. You are being sold the Jordan Belfort story by Jordan Belfort, and he is a very unreliable narrator. That's very much by design."

Despite how unlikely this story is, most of what transpires in the film actually happened. Winter added, "I assumed he must've been embellishing. But then I did some research, and I talked to the FBI agent who arrested him, who had been tracking Jordan for ten years. And he told me, 'It's all true. Every single thing in his memoir, every insane coincidence and over-the-top perk, it all happened.'"

That said, this film is Belfort's truth, not necessarily the definitive truth. Keep reading if you want to learn everything "The Wolf of Wall Street" doesn't tell you about the true story of Jordan Belfort's meteoric rise and fall.

Belfort's wives' names were changed for the film

Although their real-life counterparts are obvious, the names of Jordan Belfort's ex-wives were changed in the film, giving the filmmaker creative license with the characters. Belfort's first-wife in the film is Teresa Petrillo (Cristin Milioti), but her real-life counterpart is Denise Lombardo. Denise met Belfort in high school, and the childhood sweethearts married in 1985 after Denise graduated from college. Belfort founded Stratton Oakmont while married to Denise, and they divorced after she found out about his affair in 1991 (per The U.S. Sun ). After their divorce, Denise led a low-profile life, staying out of the public eye.

Belfort's second-wife in the film is Naomi Lapaglia (Margot Robbie). Naomi's real-life counterpart is Nadine Macaluso. Like Naomi, Nadine was a model and met Belfort at a party before they married in 1991. Nadine and Belfort had two children together and separated in 1998 as depicted in the film (per the U.S. Sun). Nadine got a Ph.D, becoming a marriage and family therapist. She lives in California with her second husband (per Daily Mail TV ).

Margot Robbie , who played Naomi in the film, met Nadine while preparing for her role. Robbie told IndieWire meeting Nadine helped her understand her character's motivations, saying, "I could do or say any horrible thing and know that my character's motivation was out of protection for her child. Whether or not the audience sees my side of events is another matter, but just to know my motivation can give me an authentic performance." She added how strong Nadine is, saying, "She's has to be, to have put up with Jordan and his shenanigans."

The original crew Belfort recruited from friends are composite characters

Although Belfort recruited the original crew for his Long Island brokerage firm from a group of friends; Alden "Sea Otter" Kupferberg (Henry Zebrowski), Robbie "Pinhead" Feinberg (Brian Sacca), Chester Ming (Kenneth Choi), and Nicky "Rugrat" Koskoff (PJ Byrne) are composite characters with fictitious names. These characters are an amalgamation of numerous people who worked at Stratton Oakmont and do not represent actual people.

This didn't stop Andrew Greene, a board member of Stratton Oakmont, from filing a defamation suit against the film's production company. He was offended by the depiction of "Rugrat" in the film, saying the character damaged his reputation. He called the character a "criminal, drug user, degenerate, depraved and devoid of any morals or ethics" (per The Guardian ).

In 2018, Greene lost his suit . In 2020, an appellate court threw the suit out, stating that the filmmakers, by creating composite characters and fictitious names, "took appropriate steps to ensure that no one would be defamed by the Film," (per the Hollywood Reporter ). The filmmaker included the hijinks of the employees at Stratton Oakmont in the film to illustrate the raucous corporate culture of the brokerage firm, rather than defame former employees.

Donnie Azoff doesn't exist, his real-life counterpart is Danny Porush

Jonah Hill 's character Donnie Azoff in "The Wolf of Wall Street" doesn't exist. He is a composite character created to avoid defaming anyone while making the film. To anyone who is familiar with Jordan Belfort and Stratton Oakmont's story, it's obvious Danny Porush is Azoff's real-life counterpart. Porush disputes the veracity of both Belfort's memoir and the film, telling Mother Jones , "The book ... is a distant relative of the truth, and the film is a distant relative of the book." Porush admits to swallowing the goldfish, but under different circumstances than depicted in the film.

As reported by Mother Jones, Porush was Belfort's friend and business partner between 1988 and 1996. Like Belfort, he cooperated with authorities, ultimately serving 39 months in prison for his securities and financial crimes at Stratton Oakmont. Porush disputes the throwing of dwarves, insists there were never animals in Stratton Oakmont — other than the goldfish he ate — but admits to the wild parties and taking part in the depravity and excesses encouraged at the brokerage firm, saying "Stratton was like a fraternity."

Porush told Mother Jones, "My main complaint [regarding the memoir] besides his inaccuracy was his using my real name," something that was remedied when the filmmakers created the composite character of Donnie Azoff. Ultimately, Porush doesn't seem to hold a grudge despite his grievances with the inaccuracies saying, "Hey, it's Hollywood ... I know they want to make a movie that sells. And Jordan wrote whatever he could to make the book sell."

Danny Porush's wife introduced Jordan Belfort to her husband

In "The Wolf of Wall Street," Donnie Azoff (Danny Porush's fictional counterpart) approaches Belfort at a restaurant about what he does for a living, after seeing Belfort's Jaguar in the parking lot. In reality, Belfort met his future business partner, Danny Porush, through Danny's wife Nancy.

Porush and Nancy lived in the same building in Queens where Belfort lived with his first wife Denise, as Nancy told Doree Lewak with The New York Post in 2013 shortly before "The Wolf of Wall Street" came out. Nancy explained how she took the same bus into the city for work as Belfort, saying, "the commute to the city each day was hard because I became pregnant right away. There was a nice boy from our building on the same bus who always gave up his seat for me. His name was Jordan Belfort, and he worked in finance ... I pushed Danny to talk to Jordan ... After just one conversation, Danny came back and announced he was taking the Series 7 exam to get his stockbroker's license."

In the New York Post article, Nancy detailed how her husband changed once he began working with Belfort and making serious cash, saying, "Up until then, Danny never seemed to care about money ... I saw him morph from a nice wholesome guy into showy narcissist whom I hardly recognized anymore." After being arrested for securities fraud, Porush left Nancy for another woman. They are now divorced, and he lives in Florida with his second wife. We can't help wondering if Nancy ever regrets introducing her ex-husband to Belfort.

Belfort's destroyed yacht once belonged to Coco Chanel

Jordan Belfort bought a yacht and named it after his second wife. In the film, the boat is named Naomi after the character played by Margot Robbie, but in real life the boat was called the Nadine . True to the film, Belfort insisted his boat's captain take the yacht into choppy waters, where the boat happened upon powerful but unpredictable mistrals, leading to the Nadine sinking into the Mediterranean Sea in an event known as Mayday In The Med . Belfort, his guests and crew, were rescued by the Italian coast guard.

What the film doesn't tell you is that Belfort's yacht had an interesting past. Belfort's vintage yacht once belonged to none other than the famous French fashion designer Coco Chanel. Chanel is known for her outspoken nature and is associated with quite a few fiercely female quotes. Chanel is quoted as saying , "As soon as you set foot on a yacht, you belong to some man, not to yourself, and you die of boredom." Rather than avoid luxury yachts all together, Chanel made the boss move of buying her own in 1961, naming her the Matilda (per Boss Hunting ).

As bizarre as this interlude of the film was, it actually happened, with one major difference. In an interview with The Room Live , Belfort explained how the group waiting to be rescued had to push the helicopter off of the boat to make room for a rescue team to lower down onto the yacht. In the film, the waves knock the helicopter off of the yacht. Belfort also explains that although his private jet also crashed, it was 10 days after the yacht sunk, not at the same time, as it was depicted in the film for dramatic effect.

Steve Madden spent time in prison for stock fraud

Although they don't talk about it in the movie, Steve Madden also went to prison for stock fraud and money laundering along with Jordan Belfort and Danny Porush. The New York Times reported in 2002 that Madden "was arrested in 2000 as a result of an investigation of a scheme to manipulate 23 initial public stock offerings underwritten by the companies Stratton Oakmont and Monroe Parker Securities ... It included the initial public stock offering of his own company in 1993."

True to the film, Danny Porush, Azoff's real-life counterpart, really was childhood friends with Steve Madden. Like Belfort and Porush, Madden loved debauchery and Quaaludes, so much so he didn't finish college because of how much he was partying. Although Madden wrote about his wild days in his memoir, his time partying with the Stratton Oakmont "fraternity" was not included in the film. Stratton Oakmont took Madden's company public, making him instantly rich ( per The New York Post ).

As reported by the New York Post, Madden wrote about this period of his life in his memoir "The Cobbler: How I Disrupted an Industry, Fell from Grace & Came Back Stronger Than Ever." In his book, Madden wrote, "Jordan was like no one else I have ever met before or since. He became one of the most influential people in my life ... I was pumping and dumping [stocks] right alongside them." Madden wound up serving 31 months for his financial crimes and his involvement with Stratton Oakmont's schemes. Unlike Porush and Belfort, Madden could continue working at his company after being released from prison.

Belfort was ordered to pay restitution to his victims

When Belfort was convicted of money laundering and stock fraud in 2003 for Stratton Oakmont's "pump and dump" schemes, he was sentenced to four years in prison and ordered to pay over $110.4 million in restitution (per Crime Museum ). Belfort only served 22 months for his crimes and a judge ordered him to pay half of his income once he was released from prison.

In 2013, just after the film was released, CNN reported Belfort had only contributed a little over $11 million to the fund for victims, much obtained from confiscated possessions. At the time the film came out, Belfort allegedly stated he would hand over all of his royalties from the film and the book. But in 2018, Fortune Magazine reported government officials claimed Belfort still owed $97 million, meaning that over the previous 5 years, Belfort only contributed an additional $2 million dollars to the victims' fund. $2 million dollars is more than most of us will ever see, but Belfort is still making good money as a motivational speaker.

As reported by Fortune Magazine, there is a disagreement between Belfort's attorneys and prosecutors over what income can be garnished for restitution. Belfort reportedly earned around $9 million dollars between 2013 and 2015, but neglected to pay half of those earnings to the victims' fund. Although Belfort claims he will feel better after he has paid the money back, he doesn't seem to be fulfilling his end of the court order. Belfort obviously still enjoys a life of luxury and it is hard to reconcile his claims of being reformed with his reluctance to pay the restitution to his victims. In her New York Post article Nancy Porush reminded us, "Greed is not good — it's ugly."

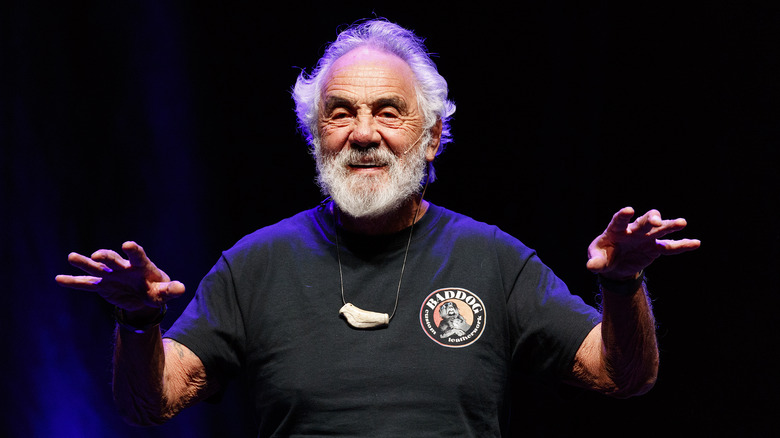

Tommy Chong was Belfort's cellmate in prison

"The Wolf of Wall Street" ends with Jordan Belfort in a cushy white-collar prison with tennis courts, but the film didn't tell us who Belfort's cellmate was. Belfort and Tommy Chong of the comedy duo "Cheech & Chong" were cellmates before Chong was released. In 2014, Belfort spoke to Stephen Galloway with The Hollywood Reporter about his time in prison. He explained, "[Chong] was in the process of writing his book. We used to tell each other stories at night, and I had him rolling hysterically on the floor. The third night he goes, 'You've got to write a book.' So I started writing, and I knew it was bad. It was terrible. I was about to call it quits and then I went into the prison library and stumbled upon 'The Bonfire of the Vanities' by Tom Wolfe, and I was like, 'That's how I want to write!'"

In 2014 Chong spoke with Adrian Lee at Maclean's about how he met Belfort in prison and giving Belfort feed back on his pages, saying "After a while he showed me what he had written, and it was the only time I had critiqued someone really heavy — usually when someone writes something, you say, 'Oh yeah, that's great, keep going.' But I knew instinctively he had a lot more to offer than what he showed me ... I told him ... 'No, you've got to write those stories you've been telling me at night. Your real life is much more exciting than any kind of imaginary story you could come up with.'"

Stratton Oakmont was never on Wall Street

Although the memoir and film are titled "The Wolf of Wall Street," Jordan Belfort only worked on Wall Street for several months in 1987 at L. F. Rothschild. Black Monday put an end to his days at a Manhattan based brokerage firm. As we see in the film, it was on Long Island that Belfort got a job at the Investor's Center selling penny stocks from the pink sheets and found his calling: his get-rich-quick scheme, selling nearly worthless stocks for a 50 percent commission to people who couldn't afford to lose the money (per NY Times ).

Belfort soon went out on his own, founding Stratton Oakmont with Danny Porush, where they began targeting rich investors using a persuasive script and "pump and dump" tactics — making Belfort, Porush and their brokers rich, while leaving their clients broke. As reported by the Washington Post in 1996, Stratton Oakmont was disciplined for securities violations as early as 1989, and continued to be disciplined almost annually.

Jimmy So with The Daily Beast, maintains, "The problem with 'The Wolf of Wall Street' is that the self-fashioned wolf was nowhere near the real Wall Street." The memoir and film made the brokerage firm seem like a much bigger deal than they really were, despite the financial ruin they left in their wake. Stratton Oakmont's offices were on Long Island, not Wall Street.

Jordan Belfort was never called 'The Wolf of Wall Street'

Scorsese's film makes it seem like Forbes gave Jordan Belfort the nickname, "The Wolf of Wall Street" when they published a takedown about Stratton Oakmont's questionable business practices. Forbes wrote an article about Stratton Oakmont's dirty deeds in 1991, but the article did not call Belfort "the wolf of wall street." In 2013, Forbes revisited Roula Khalaf's original article, where she called Belfort a "twisted Robin Hood who takes from the rich and gives to himself and his merry band of brokers."

Danny Porush, Belfort's former partner and one-time friend, told Mother Jones that nobody at the firm ever used the "wolf" moniker. As reported by CNN , Belfort came up with the nickname himself for his memoir. As Porush told Mother Jones, Belfort's "greatest gift was always that of a self-promoter." But as Joe Nocera with the NY Times said, "who would ever buy a ticket to a movie called 'The Wolf of Long Island'?"

Belfort had a head-on collision while driving under the influence of Quaaludes

When the real Jordan Belfort crashed his car while on Quaaludes, he was in a Mercedes Benz rather than a Lamborghini, and someone was actually injured. Belfort had a head-on collision while driving home from the country club where he used the pay phone, sending the woman he collided with to the hospital (per The Daily Beast ). None of Belfort's crimes are victimless.

This type of discrepancy is central to the complaints about both Belfort's memoir and the film. Although Belfort says he regrets his crimes, he is too busy boasting about the parties, the riches, the drugs, and the sex to sound like he regrets anything except getting caught. Belfort's memoir and the film it inspired might seem like a celebration of greed and excess, but they are also a depiction of the ostentatious behavior that eventually drew the attention of the authorities.

Scorsese's "The Wolf of Wall Street" might not tell you everything about the true story, but what it does is reveal how audiences love watching someone else's destructive behavior. We get all the thrills and none of the consequences. As screenwriter Terence Winter told Esquire, "I'd much rather watch somebody who isn't responsible, who makes all the wrong decisions and hangs out with the wrong people. That's more satisfying. We may live like saints, but when it comes to our fantasy life, everybody's got a little larceny in their soul."

The Fascinating True Story Behind The Wolf Of Wall Street

Even before Hollywood came calling, the real-life Jordan Belfort was equating himself to movie villains. Once a stockbroker, then a convict, then a motivational speaker, Belfort wrote of his experiences in his bestselling 2007 memoir , "The Wolf of Wall Street." It contains the line, "I had lots of nicknames. Gordon Gekko, Don Corleone, Keyser Soze; they even called me the King. But my favorite was the Wolf of Wall Street."

Cross-reference those first three alleged nicknames with the films "Wall Street," "The Godfather," and "The Usual Suspects." It soon becomes clear that Belfort, the born salesman, was all too ready to peddle himself as someone who belonged in the pantheon of great movie villains. Luckily for him (less so for the unseen victims of his financial crimes), director Martin Scorsese was happy to oblige him with a star-studded movie adaptation.

Belfort's memoir is filled with many wild stories, but some have questioned the veracity of its self-serving claims. By the time Scorsese came along and turned it into an Oscar-nominated 2013 film , audiences would be one more layer removed from the truth of what happened. The book cover reads, "I partied like a rock star, lived like a king," and inside its pages, Belfort, the "former member of the middle class," speaks in passing of "chaos capitalism."

"The Wolf of Wall Street," the movie, makes good on that dubious vision with a three-hour ode to excess, wealth, and skullduggery that's all the more unbelievable because some of it really occurred.

A conman's sworn (and swearing) testimony

Martin Scorsese, working for the fifth time with Leonardo DiCaprio as his leading man, broke his own Guinness World Record for cinematic use of the f-word with "The Wolf of Wall Street." His film "Casino" had previously set the record in 1995, but "The Wolf of Wall Street" eclipsed its 422 f-bombs with a whopping 506 of them.

That's just one interesting bit of trivia related to the movie. When you sift through all the swearing to get at the facts, though, just how much of "The Wolf of Wall Street" was true, and how much of it was embellishment — or straight fibs of the kind Keyser Soze might tell?

Jordan Belfort is not what you'd call a credible witness; in fact, the whole movie is arguably told from the perspective of a master of deceit, who scammed investors out of millions. Scorsese leveraged all his cinematic powers in service of what DiCaprio called "a modern-day Caligula" story, but he was also adapting a criminal's autobiography. That's a little different than what he did with "Goodfellas" and the aforementioned "Casino," both adapted from a nonfiction book where the gangster's tale came filtered through author Nicholas Pileggi.

"The Irishman," too, was based on a Charles Brandt book about the life of mob enforcer Frank Sheeran, whose confession was later discredited . In "The Wolf of Wall Street," the bad guy tells his own story, sometimes giving the camera a suitably wolfish grin as he does so.

Jonah Hill's character was based on Danny Porush

Terence Winter handled the screenwriting chores for "The Wolf of Wall Street," and he and Martin Scorsese framed an entire HBO series, "Boardwalk Empire," around another gangster named Nucky Thompson. Actor Bobby Cannavale – who won an Emmy Award for "Boardwalk Empire" the same year "The Wolf of Wall Street" hit theaters — narrated the original, abridged audiobook version of Jordan Belfort's memoir.

In the book, Jonah Hill's character, Donnie Azoff, is referred to by the name Danny Porush. Donnie was loosely based on the real Danny, who was Belfort's business partner and the co-founder of Stratton Oakmont, the Long Island brokerage house that becomes a circus of sex, drugs, dwarf-tossing, and pump-and-dump fraud in "The Wolf of Wall Street."

Though Porush has called Belfort's book "a distant relative of the truth," he himself married a not-so-distant relative: his own first cousin. In the movie, Belfort broaches the subject of these "rumors" over beers at a bar, eliciting Donnie's bug-eyed, toothy admission, "Yeah, my wife is my cousin or whatever." That part of Porush's personal background is true, according to Time , though he and his cousin are now divorced.

Unlike Belfort, Porush was not involved in the making of "The Wolf of Wall Street." Changing his character's name helped remove any liability the filmmakers might face for damaging his reputation. Porush reportedly threatened to sue them beforehand, so the name change was a practical decision meant to cover their bases.

What really happened at the office?

On the testosterone-filled office floor in "The Wolf of Wall Street," Jordan Belfort psyches up his stockbrokers with the words, "This right here is the land of opportunity. Stratton Oakmont is America!" It's true he used to give speeches to his employees with a microphone, which prepared him for his later life of motivational speaking. Substitute "country" for "company" in his movie speeches, and it lays bare the cultural subtext of "The Wolf of Wall Street."

In Belfort's America, money can buy anything and everyone. Sex workers were indeed charged to the company credit card, his book indicates, and Danny Porush says it's true they paid an employee $10,000 to shave her head. The movie makes a spectacle out of her doing it to get breast implants, with Belfort shouting, "This is the greatest country company in the world!"

It's not long before a half-dressed band comes marching in, followed by champagne waiters and strippers. Martin Scorsese dials everything up to 11, combining Belfort's book description of multiple parties into one hedonistic scene.

In an interview with Mother Jones (by way of History vs. Hollywood ), Porush disputed that the office ever brought in a chimpanzee on roller skates or did any dwarf-tossing at its parties. Little people are said to have attended one party, but Belfort's memoir only depicts the meeting where he and his associates discuss the hypothetical specifics of tossing them. Porush admitted, however, that the part where he/Donnie swallows a broker's pet goldfish was true.

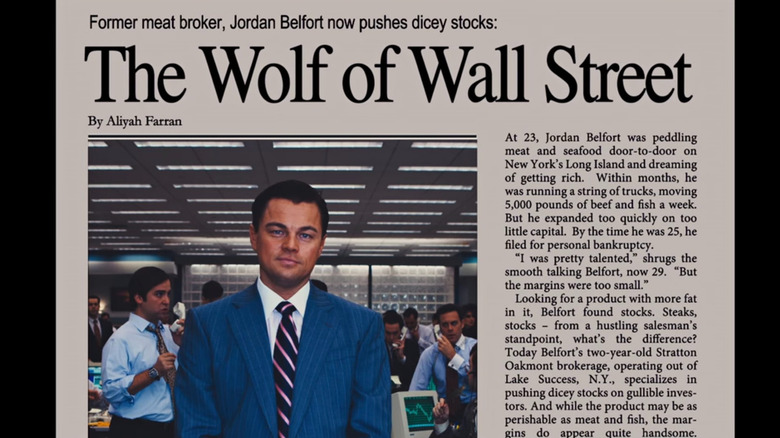

Forbes really did profile Belfort

In "The Wolf of Wall Street," there's a scene where a journalist for Forbes magazine visits the offices of Stratton Oakmont. She's doing a profile on Jordan Belfort, which winds up being "a total f***ing hatchet job" in his eyes. The article appears onscreen with Leonardo DiCaprio in his tan-faced movie poster pose below the headline "The Wolf of Wall Street." All the while, Belfort rails against the journalist labeling him that, as if she was the one who coined his nickname and the movie's title.

You can read the real 1991 article on the official Forbes site (and see a larger scanned image of it here ). The headline was actually "Steaks, Stocks — What's The Difference?" This is one of the more interesting "Wolf of Wall Street" artifacts out there, showing how the movie partially overlaps with reality. It's a "prop" anyone can access online, and it offers a real view of how someone other than Jordan Belfort viewed Jordan Belfort.

The true journalist was Roula Khalaf, not Aliyah Farran (the fictitious byline shown in the movie), though her article does contain the highlighted movie phrase "pushing dicey stocks." It also contains a line that DiCaprio performs almost verbatim about Belfort "sounding like a kind of twisted Robin Hood, who takes from the rich and gives to himself and his merry band of brokers." Yet if it wasn't Forbes that coined the "Wolf of Wall Street" nickname, that immediately opens up the question of who did.

Was Belfort ever actually called The Wolf of Wall Street?

According to CNN , Jordan Belfort himself came up with the "Wolf of Wall Street" name. Before Martin Scorsese's film premiered, Danny Porush disputed that anyone at Stratton Oakmont ever called Belfort that. In 2013, a prosecutor in the Belfort case, former assistant U.S. attorney Joel M. Cohen, likewise told The New York Times , "In all the years that we investigated him, the hundreds of hours I spent with him and his cohorts, I never heard anyone call him 'The Wolf of Wall Street.'"

Circling back to Belfort's sketchy book claim that "Gordon Gekko, Don Corleone, Keyser Soze" were among his many nicknames, he had already lumped himself together with several cinematic bad boys. By linking his name to famous movie villains, it's as if Belfort aimed to set himself up as a sort of prepackaged Hollywood deal. "I was the ultimate wolf in sheep's clothing," he writes.

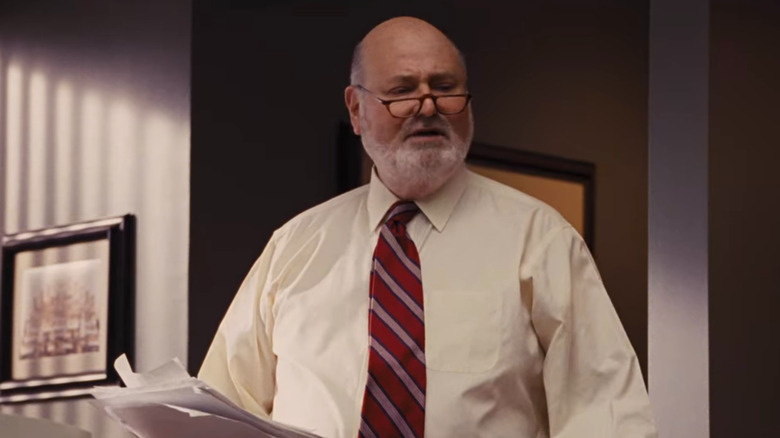

There's a part in the book where Belfort's apoplectic father, played by Rob Reiner in the movie, rattles off a whole paragraph of dialogue, which begins with, "And you, the so-called Wolf of Wall Street — the demented young Wolf!" Unless he was running a tape recorder in his office back in the 1990s, it seems unlikely Belfort would have been able to perfectly recollect such dialogue. It would appear that, rather than being incensed at his lupine nickname, Belfort anointed himself the Wolf of Wall Street as a bit of self-promotion.

What Belfort did before becoming a stockbroker

"The Wolf of Wall Street" begins with Jordan Belfort already relishing a rich and famous lifestyle. It then flashes back to him at 22, getting off the bus on Wall Street, "the one place on earth that befit [his] high-minded ambitions."

The truth is, Wall Street came a little later for Belfort. In the movie, he mentions being "raised by two accountants." Yet there's no mention of him dropping out of dentistry school (per The Independent ) or selling meat and seafood door-to-door. The latter is what prompted the wordplay in the Forbes headline, "Steaks, Stocks — What's The Difference?" Belfort's beefy business soon went under, leaving him a failed businessman at 25. It was only then that he became a stockbroker-in-training at the firm L.F. Rothschild.

Matthew McConaughey's character, Mark Hanna, was a real senior broker at L.F. Rothschild who did advise masturbation and cocaine as keys to success, according to Belfort's memoir. In a video on his verified Twitter account, McConaughey said that the character's chest-thumping chant was born of a warm-up ritual that he himself did before every take, just to get in the zone as an actor.

Biography.com reveals that Belfort started selling stocks in 1987. That was the same year future president Donald Trump published his memoir, "The Art of the Deal," while Oliver Stone's aforementioned "Wall Street," with its famous movie quote, "Greed is good," hit theaters nationwide.

Fashion designer Steve Madden was involved

Actor Jake Hoffman, who also appears in "The Irishman" and is Dustin Hoffman's son, plays designer Steve Madden in "The Wolf of Wall Street." Madden and Danny Porush were childhood friends, just as the movie depicts. The company Madden founded (and continues to design for) is still a leading name in women's shoes. In the 2021 fiscal year, its revenue jumped up to $1.9 billion.

The real-life Madden thought Hoffman's portrayal of him was "too nerdy." Though the movie implies he stabbed Jordan Belfort in the back by unloading shares after Stratton Oakmont took his company public, Madden told Page Six , "He ratted me out to save himself."

Madden wouldn't cooperate with the FBI as Belfort did, and wound up serving a longer 41-month sentence in prison (compared to Belfort's 22-month stretch). However, his life rebounded, and he's called "The Wolf of Wall Street" "a great movie." In his autobiography, "The Cobbler," Madden wrote , "The movie also raised our brand awareness with young men and increased our name recognition."

Coco Chanel's yacht went down with Belfort's marriage

When Jordan Belfort is touting Steve Madden's once-in-a-decade genius in "The Wolf of Wall Street," he compares him to other well-known fashion designers. Coco Chanel's name is sandwiched between Gianni Versace and Yves St. Laurent without further comment, but Belfort had a greater real-life connection to Chanel, as he was the last person to own her yacht.

Between the publication and filming of "The Wolf of Wall Street," Chanel's image was tarnished by revelations that she was a Nazi agent . This may be why her previous ownership of the yacht was left out, despite being included in Belfort's memoir. As seen in the movie, he did sink the yacht in a storm, and he did sink his marriage by hitting his wife and driving his car through the garage door with his 3-year-old child in front.

The yacht was named the Nadine, not the Naomi, and the same goes for Belfort's wife. Margot Robbie landed the Naomi part by going off-script and slapping DiCaprio in her improvised audition . She regretted filming their love scene on a cash bed because of all the paper cuts it left her.

The real Nadine, who went on to become a Ph.D. and TikTok-powered therapist after their divorce, said it's not true Belfort bought her the yacht as a wedding present. His abuse of her and his rough helicopter landing on their front lawn was partially fueled by a real drug problem.

Fall of the new Rome

After Jordan Belfort is caught and becomes the Rat of Wall Street, the movie portrays him heroically tipping off Donnie Azoff about him wearing a wire via a napkin message. Belfort never tipped off Danny Porush, but in his sequel book, "Catching the Wolf of Wall Street," he related a similar incident involving another friend.

By likening Belfort to Caligula, Leonardo DiCaprio somewhat aligns "The Wolf of Wall Street" with the idea that America is the new Roman Empire. His decline and fall is its decline and fall. FBI agent Patrick Denham, seen on Belfort's yacht with the American flag almost flowing out of his head, can only try and plug the dam. Kyle Chandler's all-American image as Eric Taylor in "Friday Night Lights" thus underpins Denham's character, who was based on agent Gregory Lockwood.

Former Stratton Oakmont exec Andrew Greene, the inspiration for the toupee-wearing character "Wigwam" in the book and "Rugrat" (P.J. Byrne) in the movie, unsuccessfully sued the studios behind "The Wolf of Wall Street" for libel, losing in part because of the credits disclaimer:

"While this story is based on actual events, certain characters, characterizations, incidents, locations and dialogue were fictionalized or invented for purposes of dramatization. With respect to such fictionalization or invention, any similarity to the name or to the actual character or history of any person, living or dead, or any product or entity or actual incident, is entirely for dramatic purpose and not intended to reflect on an actual character, history, product or entity."

Tommy Chong was Belfort's 'cube mate'

Tommy Chong has dozens of movie and TV credits to his name, some through his collaboration with Cheech Marin in the stoner comedy duo Cheech & Chong. He had a recurring role on "That '70s Show" and has also done activism for marijuana legalization.

As chance would have it, a nine-month sentence for selling bongs online landed Chong in the same federal prison as Jordan Belfort. The prison was so nice that it didn't even have cells, but the two men apparently shared a cubicle. New York Magazine reports that they were "cube mates" or "cubies."

In 2014, Yahoo News further reported that Chong — as Belfort's cube mate — was instrumental in convincing him to turn his life story into a memoir. At the time, Chong was writing his own book, and though Belfort would regale him with stories of his stockbroker misadventures, he had been wiling away his days in prison by playing tennis.

The movie shows Belfort on the tennis court at the end, where he brags about how being rich and living in a country "where everything was for sale" helped soften the blow when he eventually had to face the consequences of his actions.

In prison, Chong gave Belfort some writing advice after the fictionalized first draft of "The Wolf of Wall Street" read like a John Grisham knockoff. "I told him a few tricks of the trade, how to articulate the story," Chong said.

Belfort was ordered to pay restitution to his victims

While Belfort was on parole, 50% of his income went toward restitution for his victims. That ended in 2009, but for the rest of his life, Jordan Belfort has to continue paying at least $10,000 a month into a $110 million restitution fund. In 2018, a judge made a ruling to garnish more of his funds since Belfort had only paid a "fraction" of what he owed. He, therefore, has a deep incentive to continue making money.

In the film, Belfort boasts of "selling garbage to garbage men." A pivotal moment comes when his first wife, Leah (Christine Ebersole), suggests that he rethink his penny stock scheme, marketing it to "rich people who can, like, afford to lose a lot of money."

From there, Belfort's off to the races, but among his real-world victims were retirees and small-business owners, not just fabulously wealthy individuals. Some people he duped lost their life savings or the money for their children's college tuition.

What's Jordan Belfort up to today?

In 2022, The New York Times reported that Jordan Belfort was investing in NFT start-ups and other ventures, while offering his services as a consultant, sales coach, and cryptocurrency guru. For the price of one $40,000 Bitcoin, guests could attend a workshop at his luxurious Miami Beach home.

The image that emerges in the Times via words and photos is one of Belfort drinking a morning Red Bull and lounging on his couch, surrounded by blockchain disciples — all men — whose bible for the day would be Belfort's 2017 sales manual, "The Way of the Wolf." One of the guests confessed to having already stolen a copy of "The Wolf of Wall Street" from the library.

Despite his continuing prosperity, 2021 saw Belfort himself become the victim of a crypto hacker, who robbed him of $300,000 in Ohm tokens. In 2020, Belfort also made headlines for filing a $300 million lawsuit against Red Granite Pictures, one of the production companies behind the "Wolf of Wall Street" film. The suit alleged that Red Granite and its CEO had co-financed the movie with a Belfort-like bundle of dirty money , stolen from the Malaysian government.

Belfort seemed to acknowledge that his own ill-gotten gains were the result of misdirected energy, and he could have profited better off legitimate business pursuits. "I missed the internet boom," he lamented. "I would've made 100x more money."

A Lamborghini of lies mixed with the truth

At the beginning of the "Wolf of Wall Street" movie, there's a moment where Jordan Belfort is speeding down the freeway in his red Ferrari as Naomi performs fellatio on him. Through voiceover narration, he offers a quick correction: "My Ferrari was white, like Don Johnson's in 'Miami Vice,' not red." The car then spontaneously changes colors onscreen, as if to illustrate the mutability of memory and malleability of the truth.

Later, during the infamous Quaaludes scene, Belfort drives his white Lamborghini under the influence and believes he's "made it home alive, not a scratch on me or the car." Two cops subsequently drag him outside, where he sees that the car is, in fact, wrecked.

In his drug-fueled state, he had misremembered the details. The irony is, in real life (per Time ), it was a Mercedes that Belfort drove home that night, not a Lamborghini.

If cars are interchangeable in "The Wolf of Wall Street," it leaves the viewer to wonder what other facts might have been changed for artistic purposes. For some things, all we have to go on is a game of he-said, he-said between Belfort and Danny Porush.

These are the same two men whose film analogs, played by Leonardo DiCaprio and Jonah Hill, are shown smoking crack together. In 2014, Porush denied moments like that or Donnie's impromptu public masturbation ever happened, telling The Sun , "I never smoked crack and I never pulled out my penis at a party."

Are you buying it?

As a filmmaker, Martin Scorsese took creative license with Jordan Belfort's book, just as Belfort may have taken license with some of the facts of his own biography. In "The Wolf of Wall Street," Belfort self-mythologizes. It's even possible there are things he believes happened that didn't, like how we see the movie Lamborghini making it home undamaged.

As he cold-calls strangers, reads from his script on how to fleece them, and coaches Stratton Oakmont trainees on how to do the same, the film version of Belfort puts one of his victims on speakerphone. With the guys around him snickering like hyenas, Belfort pantomimes reeling in a fish before flicking off the voice on the other end of the line. He openly mocks and shows his contempt for this sucker, who we never see, because we're always in Belfort's perspective. The other person's not important to him.

By the end, Belfort has reinvented himself as a respectable citizen, someone people will pay to see and learn sales psychology from at business seminars. For the final image, Scorsese points the camera at Belfort's audience, which includes the people onscreen and the ones watching the movie.

The real Belfort cameos as the host who introduces DiCaprio onstage. The Wolf is in Auckland now, asking guys with Kiwi accents to sell him a pen, but it's the same self-reflexive pitch-me pitch that he gave his "hometown boys" earlier in the movie.

The question is, are you buying what he's selling?

- 12 Mighty Orphans

- 12 Years a Slave

- 15:17 to Paris, The

- 300: Rise of an Empire

- 80 for Brady

- A Beautiful Day in the Neighborhood

- A Journal for Jordan

- A Million Miles Away

- A Small Light

- Against the Ice

- All Eyez on Me

- All My Life

- American Gangster

- American Hustle

- American Made

- American Sniper

- American Underdog

- Amityville Horror (1979)

- Amityville Horror (2005)

- Annabelle: Creation

- Antwone Fisher

- Arthur the King

- Bad Education

- Battle of the Sexes

- Beanie Bubble, The

- Beautiful Boy

- Beauty and the Beast

- Being the Ricardos

- Best of Enemies, The

- Big Lebowski

- Big Short, The

- Big Sick, The

- Bikeriders, The

- BlacKkKlansman

- Bleed for This

- Blind Side, The

- Bling Ring, The

- Blue Miracle

- Boardwalk Empire

- Bohemian Rhapsody

- Boston Strangler

- Boys Don't Cry

- Boys in the Boat, The

- Breakthrough

- Brian Banks

- Bridge of Spies

- Burial, The

- Butler, The

- Bye Bye Man, The

- Calendar Girls

- Can You Ever Forgive Me?

- Captain Phillips

- Case for Christ, The

- Catch Me If You Can

- Charlie Wilson's War

- Chasing Mavericks

- Cocaine Bear

- Concrete Cowboy

- Conjuring 2, The

- Conjuring, The

- Conjuring: The Devil Made Me Do It, The

- Courier, The

- Crowded Room, The

- Current War, The

- Danish Girl, The

- Danny Collins

- Darkest Hour

- Dear Edward

- Death of Stalin, The

- Deepwater Horizon

- Deliver Us From Evil

- Devil Wears Prada, The

- Disappointments Room, The

- Disaster Artist, The

- Dolemite Is My Name

- Donnie Brasco

- Downton Abbey

- Dragon: The Bruce Lee Story

- Dream Horse

- Dropout, The

- Eddie the Eagle

- Emancipation

- End of the Tour, The

- Erin Brockovich

- Exorcism of Emily Rose, The

- Extremely Wicked, Shockingly Evil and Vile

- Eyes of Tammy Faye, The

- Fabelmans, The

- Farewell, The

- Fault in Our Stars, The

- Favourite, The

- Fighter, The

- Fighting with My Family

- Finding Neverland

- Finest Hours, The

- Five Days at Memorial

- Flamin' Hot

- Florence Foster Jenkins

- Ford v Ferrari

- Founder, The

- Free State of Jones

- Freedom Writers

- Gigi and Nate

- Girl from Plainville, The

- Glass Castle, The

- Goldbergs, The

- Good Nurse, The

- Good on Paper

- Goodbye Christopher Robin

- Gran Turismo

- Greatest Beer Run Ever, The

- Greatest Showman, The

- Gridiron Gang

- Hacksaw Ridge

- Hands of Stone

- Haunting in Connecticut, The

- Heaven is for Real

- Hidden Figures

- Hillbilly Elegy

- Hollywoodland

- House of Gucci

- Hurricane, The

- I Am the Night

- I Can Only Imagine

- I Saw the Light

- I Still Believe

- I Wanna Dance with Somebody

- Imitation Game, The

- Infiltrator, The

- Inventing Anna

- Irishman, The

- Iron Claw, The

- Jerry and Marge Go Large

- Jersey Boys

- Jesus Revolution

- Jimi: All Is by My Side

- Judas and the Black Messiah

- Kill the Messenger

- Killers of the Flower Moon

- King Arthur

- King Richard

- Lady in the Lake

- Last Duel, The

- Last Full Measure, The

- League of Their Own, A

- Lone Survivor

- Lost City of Z, The